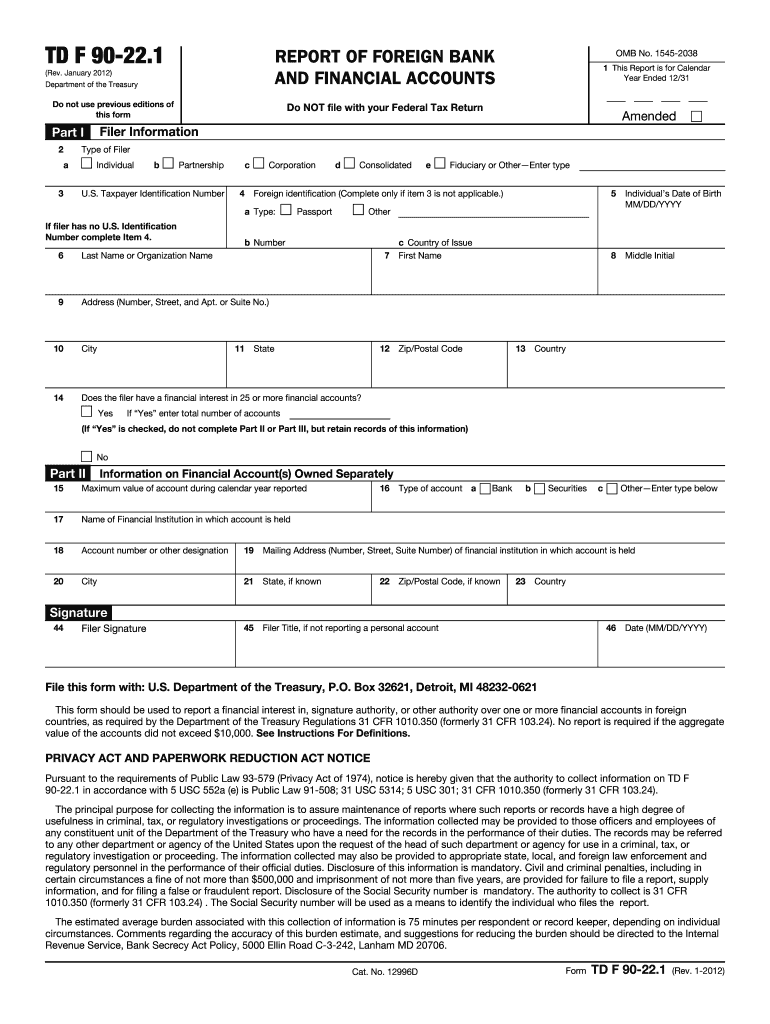

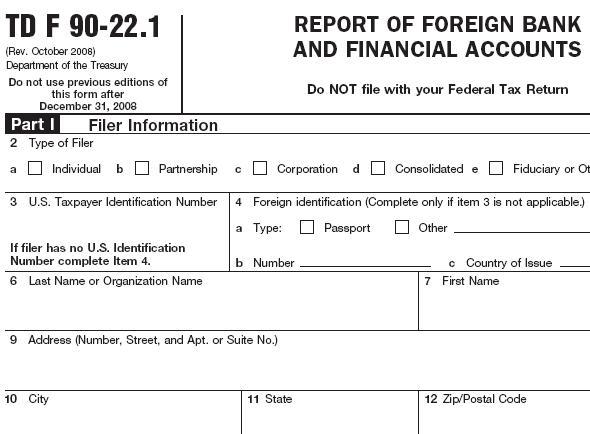

Td F 90 22 1

If you have a financial interest in or signature authority over a foreign financial account including a bank account brokerage account mutual fund trust or other type of foreign financial account exceeding certain thresholds the bank secrecy act may require you to report the account yearly to the internal revenue service by filing electronically a.

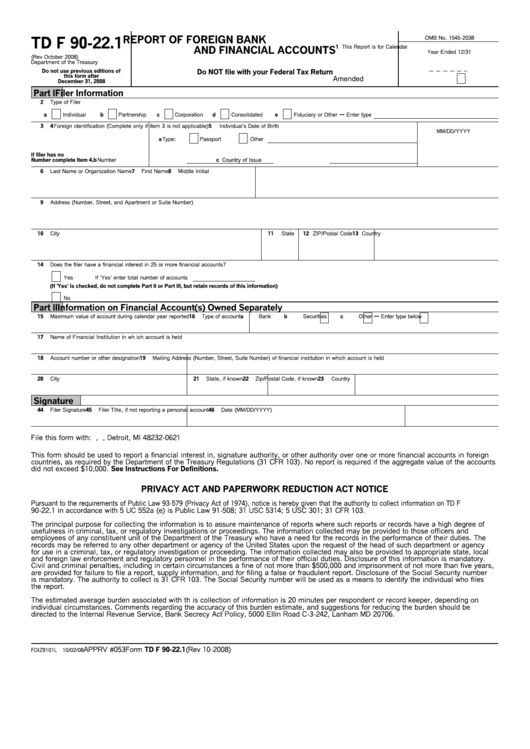

Td f 90 22 1. 12996d form td f 90 22 1 rev. Td f 90 22 1 form the website is full of fillable and printable templates you can fill edit sign print save or even send immediately. 1 2012 part ii continued information on financial account s owned separately form td f 90 22 1 page number of complete a separate block for each account owned separately this side can be copied as many times as necessary in order to provide information on all accounts. Reports will be available using the bsa e filing system.

Form td f 90 22 1. Starting with the 2013 tax year the report of foreign bank and financial accounts fbar is no longer applicable and form td f 90 22 1 has been replaced with an updated form fincen form 114. Fbar and the bank secrecy act. Create your documents via computers and mobiles and forget about any software installing.

Td f 90 22 1. January 2021 uspaitment of the treasury do not use previous editions of tmt farm report of foreign bank and financial accounts do not tile with your federal tax return 1545 2036 2 31 2 a c individual b partnershlp c c corporalion 3 u s. If you hold or control the distribution of a foreign account you may need to submit fbar tax forms. Report of foreign bank and financial accounts.

Written by gary carter posted in fbar filing form 114 foreign bank account reporting. Td f 90 22 1 do not file with your federal tax return type of filer filer information form td f 90 22 1 rev. Tax form td f 90 22 1 is the old fbar form that has been discontinued and replaced by fincen form 114. Fincen form 114 is available for e filing in the 2013 tax year.

Td f 90 22 1 irev. Fbar fincen form 114 formerly td f 90 22 1 report of foreign bank and financial accounts.